does indiana have a inheritance tax

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. On The Federal Level There Is No Inheritance Tax.

Free Indiana Affidavit Of Heirship Form Pdf Word

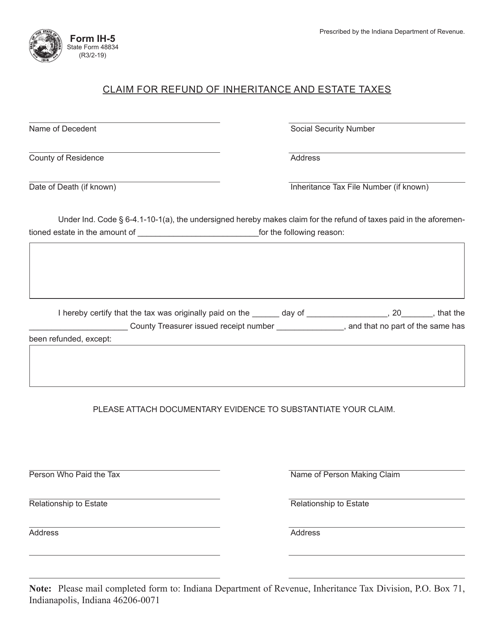

Code 6 -41-10-1 was amended to require anyone claiming a refund.

. Indiana inheritance tax was eliminated as of January 1 2013. On the federal level there is no inheritance tax. Indiana Estate Tax.

State inheritance tax rates range from 1 up to 16. No inheritance tax returns Form IH-6 for Indiana residents and. The short answer to this question is yes the inheritance is marital property.

The Inheritance tax was repealed. The amount can be doubled for a married couple with properly drafted Wills or Trusts. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person.

India doesnt have inheritance tax. All property belonging to either or both spouses. Everything You Need to Know - SmartAsset There is no estate tax in Indiana.

Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. Indiana does not levy a gift tax. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent.

It is one of 38 states in the country that does not levy a tax on estates. Up to 25 cash back Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other. The tax would have been repealed for decedents dying after 12312021.

At this point there are only six states that impose state-level inheritance taxes. Twelve states and the. Kentucky and New Jersey are close behind with top rates of 16 percent.

If inheritance tax is paid within three months of the. As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property. Indiana operates under the one pot theory of marital property.

In 2013the inheritance tax refund statute Ind. In Indiana there are several ways that estate administration can be handled depending on the level of supervision required and the amount of assets in the estate. There is no federal inheritance tax but there is a federal estate tax.

Indiana repealed the inheritance tax in 2013. Although some indiana residents will have to pay federal estate taxes indiana does not have its own inheritance or. There is no inheritance tax in Indiana either.

No inheritance tax has to be paid for individuals dying after December 31 2012. For those who do not plan the amount of Federal Estate Tax that will be required to be paid can. The federal government has a gift tax though with a yearly exemption of 15000 per recipient.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Here in Indiana we did have an inheritance. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

About 4100 estate tax returns were filed for people who died in 2020 of which only about 1900 estates were taxable less than 01 percent of the 28 million people expected to. Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individuals death. If you inherited an immovable property.

The inheritance tax exemption was increased from 100000 to 250000 for certain. February 24 2021 Janelle Fritts In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. However you may need to pay income tax capital gains tax and wealth tax on your inheritance.

Out Of Ideas As Gop Readies For More Tax Cuts Experts Say Indiana Is Falling Behind Wbiw

Out Of Ideas As Gop Readies For More Tax Cuts Experts Say Indiana Is Falling Behind Wbiw

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

State Death Tax Hikes Loom Where Not To Die In 2021

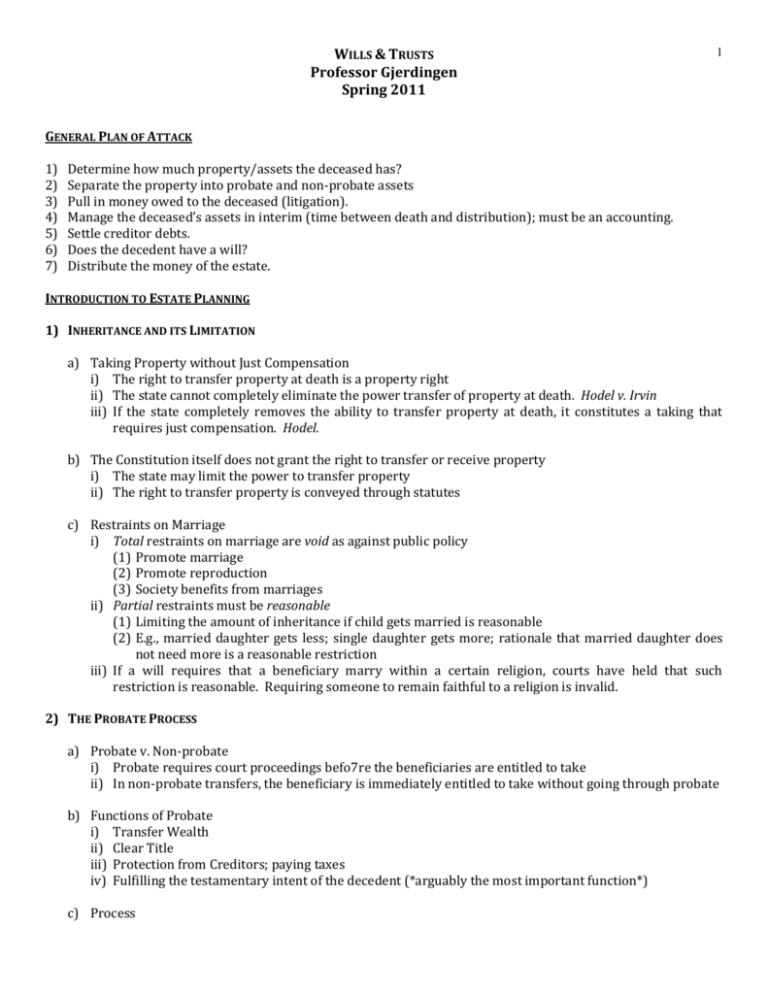

Introduction To Estate Planning Indiana Journal Of Global Legal

Power Of Attorney Ih 28 Indiana

![]()

Dor Business Education Outreach Program

Estates Probate Chriswell Law Offices

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller